Financial Services

Automation that is Flexible & Secure

Financial institutions, including banks and credit unions, are no strangers to digital transformation. Today, they rely on technology more than ever to conduct business, comply with regulations, connect with customers, and handle an influx of emergency business.

Initium SoftWorks (ISW) offers expertise in back-office operations and branch automation using consultative approaches, technology, and decades of industry experience in the fintech space.

Accelerate Work

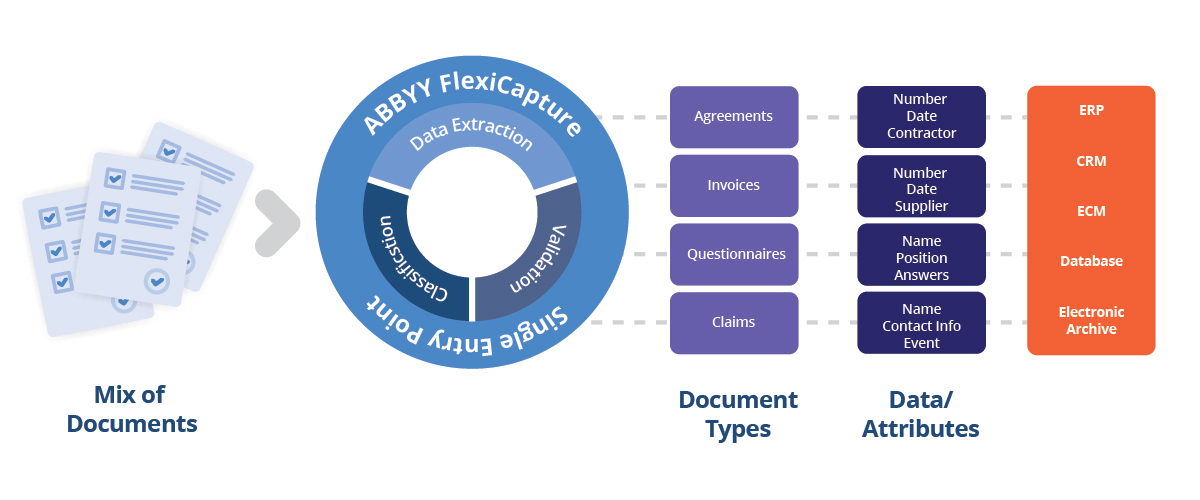

Expedite process automation using Intelligent Data Capture (IDC) and Robotic Process Automation (RPA) to:

- Turn documents and data into actionable information

- Automate complex processes and eliminate manual tasks

- Create a paperless environment that takes your business processes to a higher level of efficiency

Efficiently store, organize, protect, and share information with immediate access as documents and data. Sharing this data can expedite many financial institution functions, including loan processing, customer experiences, exception handling, credit applications, and more.

Faster Loan Approvals

Replace costly and inefficient manual operations with IDC and RPA. Automatically capture loan information from loan packages to identify missing data documents. Verify loan information across loan origination systems and your core automatically.

Improve Customer Service

Streamline and automate daily operations, such as account openings and credit card and loan applications. Get a full 360-degree view of customer records in one place for a better customer experience. Increase efficiencies on the teller line through integrated record lookups right from the teller applications.

Gain Strategic Insight Into Your Process

Enable trace and audit of the acquisition of all customer and application data for regulatory compliance. Provide secured and targeted record access for auditors.

Transform Streams of Documents Into Actionable Data

Financial Services Use Cases

Anti Money Laundering (AML) and Know Your Customer (KYC)

ABBYY’s Digital Intelligence platform offers many core capabilities for know your customer (KYC), including Process Intelligence and Content Intelligence solutions that can be targeted specifically at key areas of vulnerability. Provide integrated ID records when needed directly from your core applications.

London Interbank Offered Rate (LIBOR) Transition

Apply artificial intelligence (AI) and machine learning to the complex London Interbank Offered Rate (LIBOR) remediation process to implement a frictionless process for reviewing hundreds or thousands of documents.

NAV Oversight

Accelerate NAV Oversight by capturing, normalizing, and validating document and data files sent from any administrator using Intelligent Data Capture (IDC).

Fraud Prevention

Audit and validate document information against KYC/AML rules and flag suspicious activity for investigation.

Departments

Accounts Payable

All your documents and invoices can be captured electronically, indexed automatically with data from your ERP or accounting software, and made available for processing immediately.

Finance

Use technology to conduct business, comply with regulations, connect with customers, and handle an influx of business.

Human Resources

HR Automation can improve efficiency and reduce cycle time for HR departments by digitizing and simplifying digital content and document-centric tasks. Ensure compliance with HR policies across the institution.

Legal & Compliance

Protect your organization from risk and compliance failure through a central repository controls access using rules that are set up to your requirements and compliance needs.

Request a Consultation for Financial Services Automation

Meet with an ISW expert to discuss automation opportunities at your financial institution.