Automate Your Banking Processes

Reduce Operating Costs and Secure Customer Confidence

Customers expect banks to have the most advanced technology capabilities. We know the truth is more complicated than that. Digital transformation, process automation, and optimized workflows can all seem like massive hurdles. Your team doesn’t have enough time. The budget doesn’t have enough room. That merger or acquisition put you way too far behind to consider anything new. We’ve heard this before.

But optimizing or automating your operations to save your business time and money is not nearly as complicated as you think.

Initium SoftWorks can help you reset your strategy and manage your operating cost-down, while further securing your customer relationships. It doesn’t matter if your journey is beginning, nearly complete, or stalled, our team is ready to guide your team to incredibly improved operational efficiency.

Start using technology to your advantage.

Developing Specialized Workflows

You know your procedures take too long and are too confusing. At ISW, we specialize in efficiency and can take even the most complicated processes and hand your team a closed-loop cycle that looks smooth in comparison to tellers and management alike. Let your team spend time on the tasks that matter, not repetitive manual tasks.

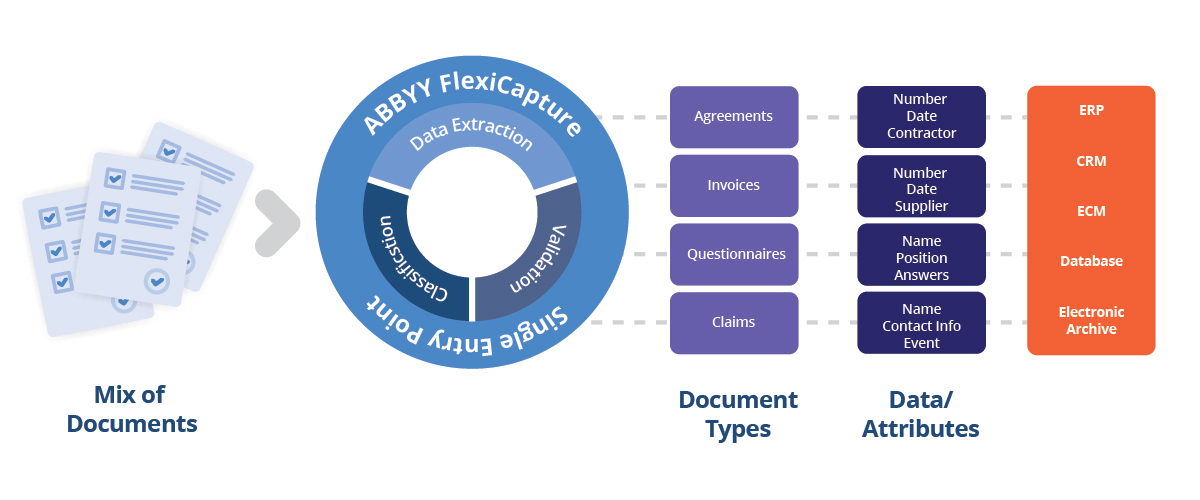

Intelligent Document Processing

Paperwork can get out of hand fast—don’t even mention lending documents. Your team has to hunt to the ends of the earth, watch out for regulation riddles, try to keep it all neat, and cannot risk starting over again. It’s an extraordinary waste of time, and everyone knows it. By combining Intelligent Data Capture (IDC) and Robotic Process Automation (RPA) technologies, our team can help guide you to easier, faster, and safer document storage and data collection, taking considerable hours and headaches off your team’s hands.

End Navigating Multiple Systems

Have you ever had to search through a bunch of different applications displayed on multiple screens to answer one little question? It’s like never finding that last piece of a puzzle to finish the picture. And even though you know it should have only taken 5 minutes, you (or one of your team members) end up spending an hour on it? Let’s end that. ISW can eliminate data silos by integrating all of your data in a single location.

Minimize Disruption

Mergers and acquisitions are exciting, new, and happen all the time, but what no one tells you is that the average bank needs 2-3 years to recover. Everything goes a little wrong, and the bank can lose a lot of process traction and money. ISW can help you skip to the good stuff, optimize your customer experience, and keep your team morale high before anyone even signs the line. Our team can provide strategies and tools to easily make this transition.

Let’s Talk About Integration

You have a handful of legacy platforms that run your business. The problem? They do not work together, and now, it’s costing you time and money. It doesn’t have to. Really, it can be so much easier than this.

We have some great integrations and we are always developing new ones, meaning we have the capacity to develop customized options to fit your bank like a glove.

Let’s set you up with a single source for all your information related to a single customer.

Transform Streams of Documents Into Actionable Data

How We Take Care of Your Most Costly Challenges, One Process At A Time

Automated Report Generation

Having quality information, intelligence, and business analytics is vital to understanding your operation at any point in time. Automating the report generating process entails a variety of operations such as optimizing data extraction from both internal and external systems, developing reporting templates, reviewing, and reconciling reports. Many banks and financial service providers have adopted RPA to automate these report generating operations.

Streamline and Scale Lending Operations

Lenders today are under immense pressure from surging mortgage demand, massive small business relief programs, and thin margins – manual processes and applications can’t scale with current demands. Application Programming Interfaces (APIs) can streamline expensive manual processes and allow lenders to quickly deliver connected borrower experiences.

Customer Onboarding

Banks deal with an avalanche of regulatory requirements when onboarding new customers. On top of gathering personal and financial data, bank employees need to verify the data through approved governmental organizations, set up an account, and establish data archiving and monitoring processes. RPA technology can automate most of these processes, significantly decreasing errors, operational costs, risks, and the time it takes to onboard a new customer.

Loan Applications Processing

The loan application procedure is a fantastic option for RPA technology to show its potential. Few primary manual activities include data extraction from applications, verification against different identity documents, and creditworthiness evaluation. We helped a client reduce their processing time from 30-45 minutes per application down to just 10 minutes.

Departments

Accounts Payable

All your documents and invoices can be captured electronically, indexed automatically with data from your ERP or accounting software, and made available for processing immediately.

Finance

Use technology to conduct business, comply with regulations, connect with customers, and handle an influx of business.

Human Resources

HR Automation can improve efficiency and reduce cycle time for HR departments by digitizing and simplifying digital content and document-centric tasks. Ensure compliance with HR policies across the institution.

Legal & Compliance

Protect your organization from risk and compliance failure through a central repository controls access using rules that are set up to your requirements and compliance needs.

Related Resources

ISW Integration Solutions

ISW's Enterprise Content Services

Advancing the Digital Journey in Financial Services

Request a Consultation to Discuss Your Challenges

Meet with an ISW expert to discuss your toughest technology challenges.

Find out how we can help you automate and integrate to reduce operating costs and secure customer confidence.